With SEPA-Transfer you can create five different types of direct debits:

•Direct debits as direct debit authorizations

•Direct debits as direct debit orders

•SEPA core direct debits (Core)

•SEPA core direct debits (Cor1)

•SEPA business-to-business direct debits (B2B)

Details on national and cross-border direct debits can be found in the chapters

•Notes on national direct debits

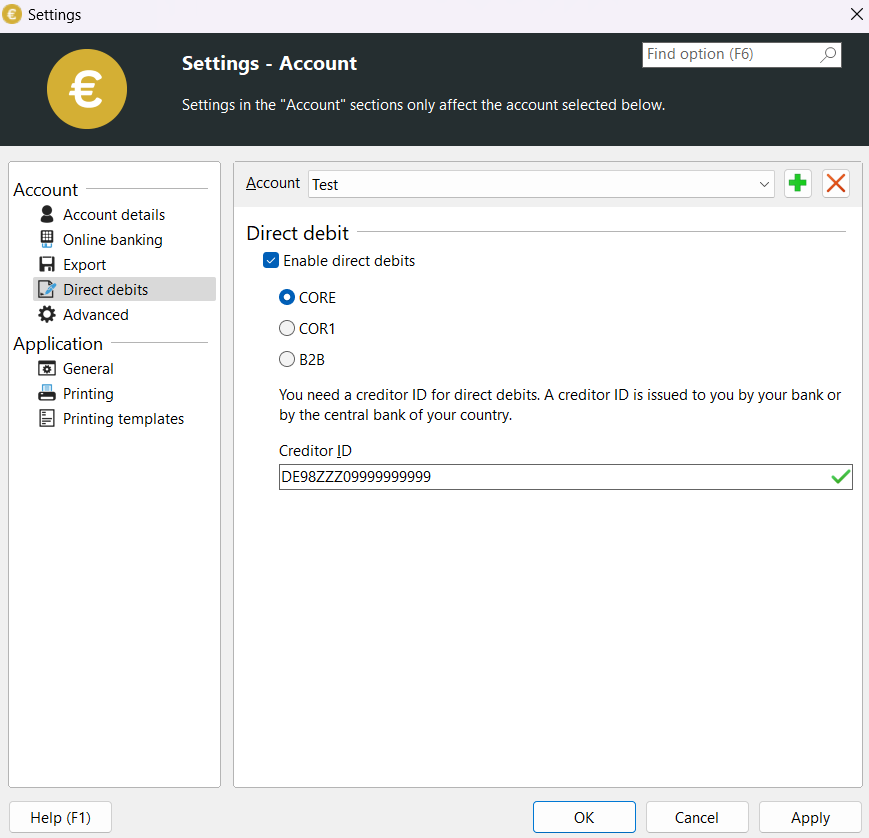

You can define the type of direct debits to be created in the settings dialog.

Notes on national direct debits

Either a direct debit authorisation or a direct debit order, which represents a legally valid contractual relationship between the debtor and the creditor and authorizes the creditor to collect a payment from the debtor's account, is mandatory for the collection of national direct debits.

With the amendment to the General Terms and Conditions (GTC) of the Volksbanken and Sparkassen as of July 9, 2012, direct debit authorizations issued are also valid SEPA direct debit mandates - provided that the creditor informs the debtor in good time.

National direct debits require the account number and bank sort code for correct allocation to the debtor's account.

Direct debits as direct debit authorization

In the case of a direct debit authorization, the payee has a direct debit authorization signed by the debtor. This can be revoked.

Direct debits as a direct debit order

In the case of a direct debit as a debit order, the debtor's bank must have an order signed by the debtor authorizing the bank to book the direct debit. As a rule, individual direct debits cannot be revoked.

General information on SEPA direct debits

SEPA direct debits are cross-border direct debits that can be made in all euro countries as well as Denmark, Great Britain, Iceland, Liechtenstein, Switzerland and some other countries.

For SEPA direct debits, you need the payer's international bank account number IBAN. More on this in the SEPA supportchapter .

The basis for collecting SEPA direct debits is the SEPA direct debit mandate. By signing the mandate, the debtor agrees that the creditor may collect direct debits from their account.

SEPA-Transfer automatically generates the required SEPA mandate reference for you. However, the reference can also be entered manually or specified during import. The mandate references generated by SEPA Transfer consist of the last 18 digits of the IBAN, date and time as well as a consecutive counter.

Format example for a SEPA mandate reference (generated by SEPA-Transfer):0123454678958550130/200220121430/001

When creating mandate references, please note that there are three different types of mandates: Individual mandates, initial mandates and recurring direct debit mandates. The latter two are collectively referred to as multiple mandates. The type of SEPA mandate affects the lead time (see below). From SEPA standard version 3.0, all recurring direct debits are created with a mandate for recurring direct debits, as initial direct debits are no longer required from this version onwards.

A creditor identification number (creditor ID) is a prerequisite for collecting SEPA direct debits. This can be requested from the Bundesbank.

Notes on lead times

A mandate of the appropriate type and a creditor ID are required for a SEPA direct debit. SEPA direct debits are subject to a so-called lead time (also known as the lead time or presentation deadline). This determines how many days before the due date the direct debit must be received by the bank. The following values apply:

Direct debit type |

Single or first direct debit |

Follow-up direct debit |

SEPA core direct debit (CORE) |

5 bank working days |

2 bank working days |

SEPA core direct debit (CORE) from SEPA standard version 3.0 |

1 bank working day (first direct debit not applicable) |

1 bank working day |

SEPA core direct debit with shortened lead time (COR1) |

1 bank working day |

1 banking day |

SEPA Business-to-Business Direct Debit (B2B) |

1 banking day |

1 banking day |

Note: As many banks add an additional bank working day, SEPA-Transfer increases the lead times specified here by an additional bank working day. This behavior can be changed in the settings in the "Advanced" section.

SEPA advance information

Before a SEPA direct debit is collected, the debtor must be informed about the upcoming direct debit. This notification is referredto as advanceinformation and can be sent with the invoice, for example. The pre-notification must state the due date and the amount of the direct debit. An advance notice may also announce several direct debit collections. It must be sent to the debtor at least 14 days before the due date, unless another period has been agreed.