Note: |

|---|

Some of the features mentioned here are only available in the Enterprise Edition. Here you will find a detailed comparison of the Small Business Edition and the Enterprise Edition. |

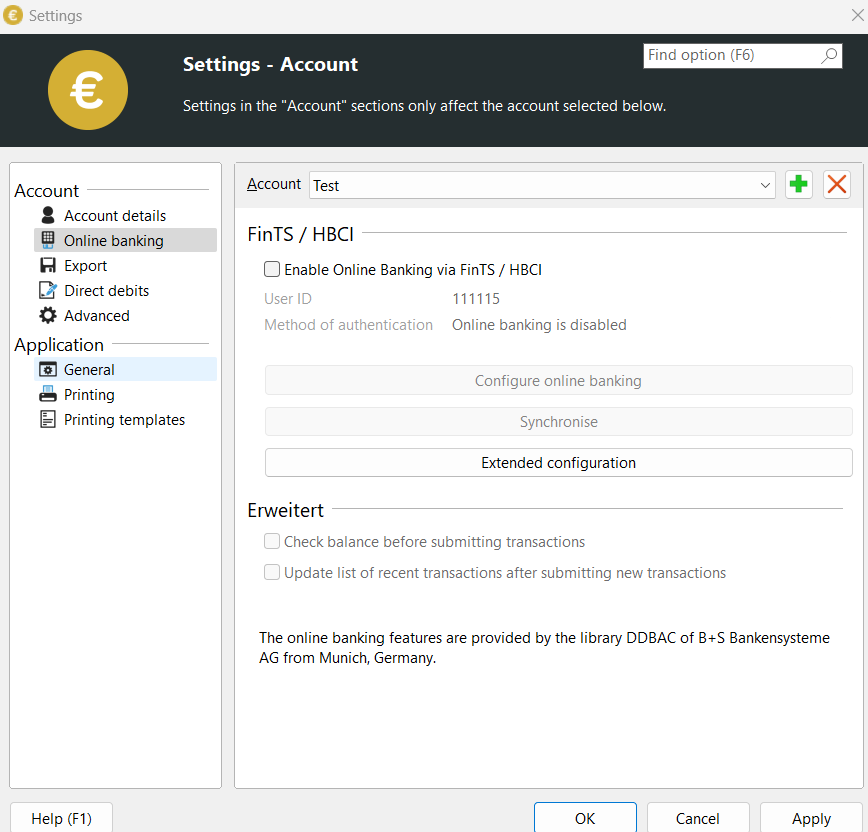

SEPA-Transfer supports the transfer of credit transfers and direct debits via online banking. To transfer via HBCI/FinTS, you need to have set up your access under Settings > Online banking and synchronized it with your bank. You will be asked to do this when you create the contact. You will receive your user ID from your bank.

1.Create bookings as transfers or direct debits. The bookings are listed in "Current bookings" on the left-hand side of the main window.

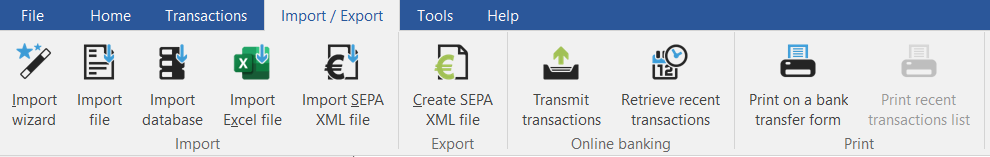

2.You can now click on the "Transfer SEPA bookings" icon in the "Online banking" menu (see illustration).

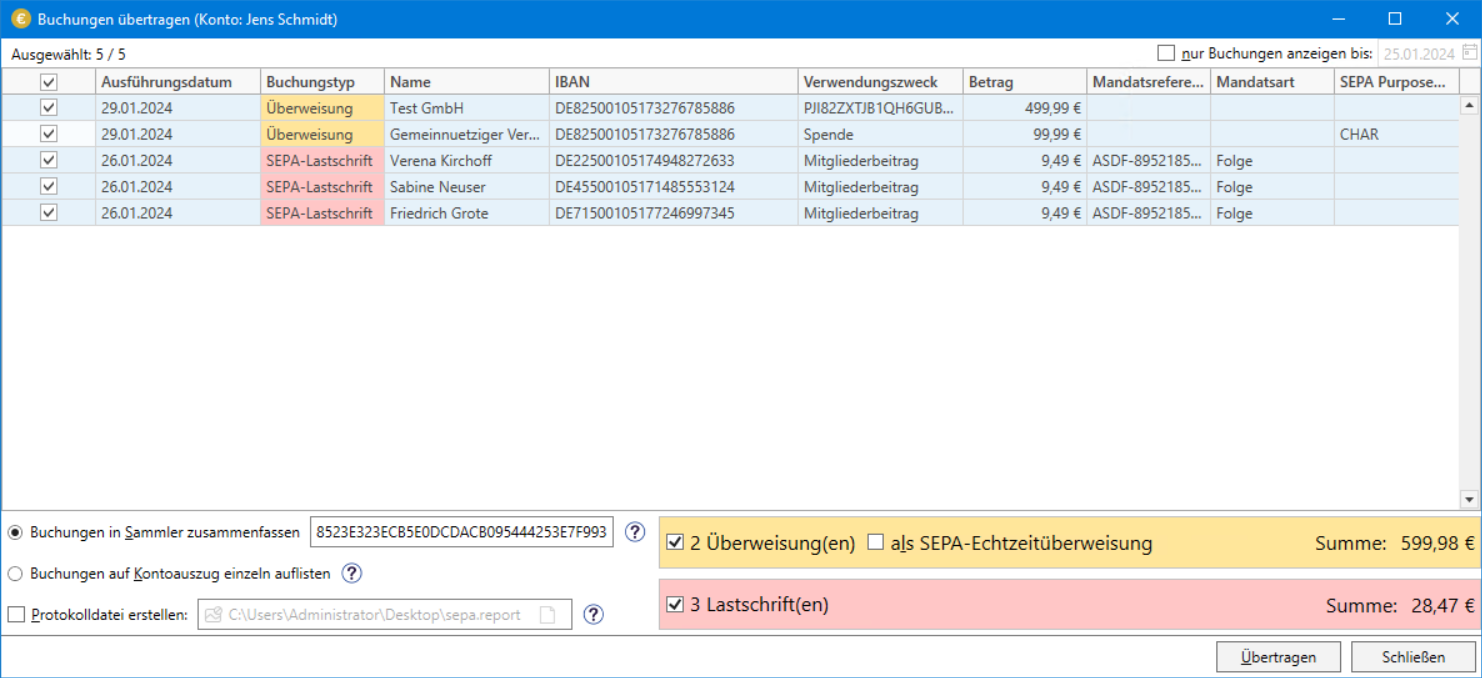

3.The "Transfer SEPA bookings" dialog opens. In this dialog, you can filter out postings that are not yet due according to their date or select or deselect postings individually.

4.You can change the default behavior (postings are displayed as a collective item on the account statement) using the option "Combine postings in collector" / "List postings on account statement individually".

This option is only available if there are several postings of the same type.

Please also refer tothis important FAQ entry.

5.Optionally, you can define a collector reference. Ifyou do not do this, SEPA-Transferwill create one itself.

This option is only available in the Enterprise Edition if "Combine bookings in collector" has been selected.

6."Create log file" leads to the creation of an Excel log file containing all successfully exported transactions.

The path may also contain system variables.

This option is only available in the Enterprise Edition.

7.The total of all selected transactions is displayed at the bottom right.

There you will also find the option to explicitly switch either credit transfers or direct debits (or both) on or off for the export and the option to execute all credit transfers as SEPA real-time credit transfers.

SEPA real-time credit transfers are usually received by the recipient within a few seconds. If you receive an error message when transferring SEPA real-time transfers, please contact your bank to find out whether SEPA real-time transfers can be transferred with your account.

Please note that SEPA instant transfers may incur charges depending on the bank and account type. You should therefore ask your bank in advance about possible costs.

Wage or salary payments and capital formation benefits can also be transferred as SEPA instant transfers in principle. However, as the field provided for this information in the SEPA format for SEPA instant transfers is optional, it cannot be guaranteed that the postings will actually be posted to the payee's account as wage or salary payments or capital-forming benefits. In case of doubt, the payments are processed as normal SEPA instant transfers. The same applies to the "End-to-end reference" field: This field may not appear on the payee's bank statement. The information can either already be filtered out by your bank or that of the payee.

8.After clicking on "Transfer", the selected transactions are transferred to the bank. This may require the entry of several TANs, e.g. if:

•Transactions with different execution dates are to be transferred.

•both credit transfers and direct debits are to be transferred together.

•both direct debit types are to be transferred together.

•SEPA real-time credit transfers are to be transferred.

•the setting to check the account balance before transferring the transactions is activated.

9.All successfully transferred transactions are then automatically marked as "executed" and are therefore no longer displayed in the main window.